Inherited ira tax calculator

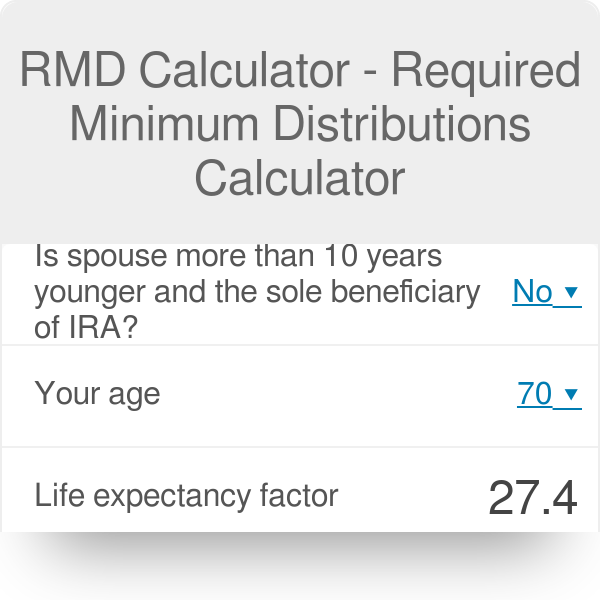

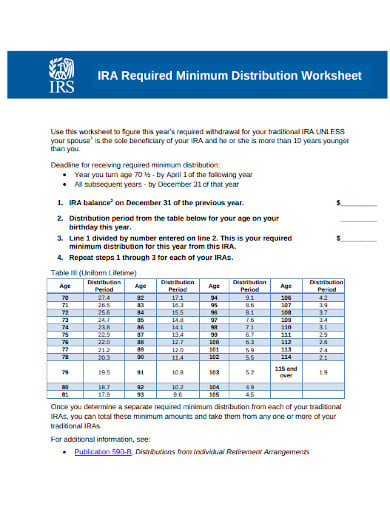

Can take owners RMD for year of death. RMD amounts depend on various factors such as the beneficiarys age type of beneficiary and the account value.

Rmd Calculators Required Minimum Distributions Charles Schwab Required Minimum Distribution Inherited Ira Financial Planner

Year of RMD The year to calculate the Required Minimum Distribution RMD.

. 1 to 31 Year. Use younger of 1 beneficiarys age or 2 owners age at birthday in year of death. An inherited IRA is an account opened to distribute the assets of a deceased owner of an individual retirement account IRA or employer-sponsored plan to the beneficiary or beneficiaries.

Open an Inherited IRA. Reduce beginning life expectancy by 1 for each subsequent year. Life expectancy method Option 2.

Open an Inherited IRA. Use oldest age of multiple beneficiaries. The inherited IRA 10-year rule refers to how those assets are handled once the IRA changes hands.

If you inherit IRA assets from someone other than your spouse you have several options. Yes Spouses date of birth Your Required Minimum Distribution this year is 0 How is my RMD calculated. Schwab Can Help You Through The Process.

Discover The Answers You Need Here. If you dont take the RMDs from your account you will be subject to a penalty equal to 50 of the amount that should have been withdrawn. However this rule doesnt apply to everyone.

Calculate your traditional IRA RMD Your date of birth Account balance as of 1231 of last year Is your spouse the primary beneficiary. Spouses non-spouses and entities such as trusts estates or charities. Thats because you can start taking distributions from an inherited IRA early without incurring the 10 penalty.

10 year method Option 3. If inherited assets have been transferred into an inherited IRA in your name this calculator may help determine how much you may be required to withdraw this year from the inherited account. RMD amounts depend on various factors such as the decedents age at death the year of death the type of beneficiary the account value and more.

Inherited IRAs either need to be distributed within five years of receiving them or that time period can be extended so that inherited assets can be distributed over the beneficiarys life. This is best for people who have not yet reached the age of 595 and wish to take distributions. A second option for inheriting IRA assets from your spouse is to instead transfer them into an inherited IRA.

What is your tax rate on an inherited IRA. Distribute using Table I. Transfer the assets to an inherited IRA and take RMDs.

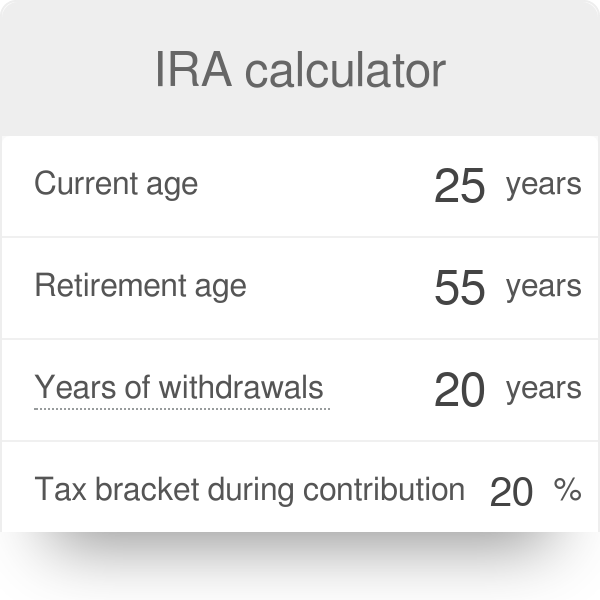

To determine what your withdrawal options might be select the Identify Beneficiary Options button below. IRA Calculator The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings. Open an Inherited IRA.

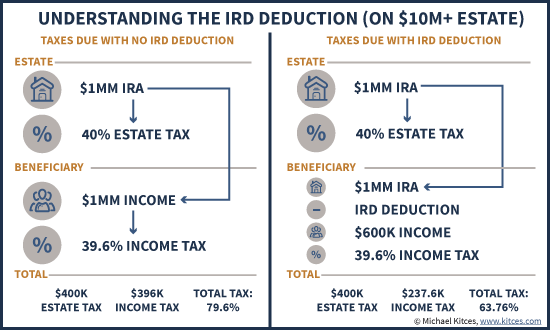

Account balance as of December 31 2021 7000000 Life expectancy factor. If inherited assets have been transferred into an inherited IRA in your name this calculator may help determine how much may be required to withdraw this year from the inherited account. That means that if the estate is large enough its possible it will owe estate taxes.

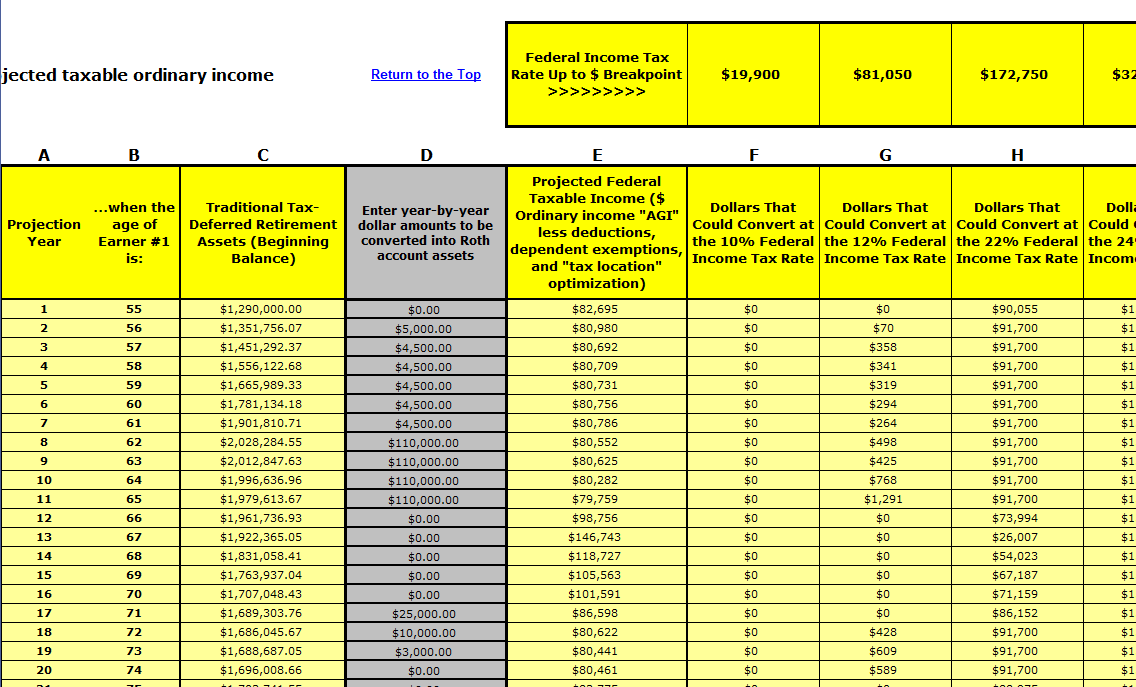

If this situation occurs this calculator will use the account owners age when calculating RMDs. You can also explore your IRA beneficiary withdrawal options based on your circumstances. Use this calculator to provide a hypothetical projection of the required minimum distributions for you and your beneficiary.

Ad Learn more about Fisher Investments advice regarding IRAs taxable income in retirement. When an IRA owner passes away the account is passed on to the named beneficiary. For comparison purposes Roth IRA and regular taxable savings will be converted to after-tax values.

Other than using the account owners age at death the calculation is identical to the one stated above. If you want to simply take your inherited money right now and pay taxes you can. Rather for IRA owner deaths that occur after December 31 2019 a designated beneficiary must deplete the account within 10 years unless the person is an eligible designated beneficiary.

Learn More About Inherited IRAs. If you inherited an IRA such as a traditional rollover IRA SEP IRA SIMPLE IRA then the rules around RMDs fall into 3 categories. Lump sum distribution Roth IRA.

An inherited IRA is considered part of a deceased persons estate. How is my RMD calculated. Inherited IRA RMD Calculator Charles Young The Internal Revenue Service requires owners of Individual Retirement Accounts to withdraw a part of their tax-deferred savings every month.

What can or cannot be done with an inherited IRA and how distributions from the account are made both depend on who the beneficiary is or beneficiaries are. This is typically the current year. Ad Inherited an IRA.

Inherited IRA Distributions Calculator keyboard_arrow_down. It only applies only to those that are over the age of 72 or 70 and a half if attained before 2020. Determine beneficiarys age at year-end following year of owners death.

1 to 12 Day. But if you want to defer taxes as long as possible there are certain distribution requirements with which you must. Lump sum distribution Account holder over 72 If the account holder was over 72 these are your choices.

Use our Inherited IRA calculator to find out if when and how much you may need to take depending on your age. To calculate Roth IRA with after-tax inputs please use our Roth IRA Calculator. As a nonspouse beneficiary if you decide to transfer inherited IRA assets from the original owners IRA to an inherited IRA in your name the assets do not get to stay in your inherited IRA account.

1920 to 2022 What is your date of birth. Enjoy Tax-Deferred Growth No Early Withdrawal Penalty When You Open An Inherited IRA. Paying taxes on early distributions from your IRA could be costly to your retirement.

Life expectancy method Option 2.

Ira Future Withdrawal Calculator Forecast Rmds Through Age 113

Traditional Roth Iras Withdrawal Rules Penalties H R Block

Roth Ira Conversion Calculator Excel

Rmd Calculator Required Minimum Distributions Calculator

Traditional Vs Roth Ira Calculator Roth Ira Calculator Roth Ira Money Life Hacks

Inherit An Ira Recently Irs Revised Pub 590 B Corrected On May 25 2021

The Ird Deduction Inherited Ira Beneficiaries Often Miss

Inherited Ira Rmd Calculator Td Ameritrade

Pin By Pinna Birdie On Financial Affairs In 2022 Inherited Ira Ira Roth Ira Contributions

Ira Withdrawal Calculator Store 57 Off Www Ingeniovirtual Com

The Mega Roth An Interesting Twist For Super Savers Under The Proposed New Secure Act Tax Free Savings Retirement Money Savers

Pin On Personal Finance

Ira Calculator

Can An Inherited Ira Be Rolled Over Smartasset

Self Employed Here Are 5 Retirement Savings Options For You The Motley Fool Saving For Retirement Investing For Retirement The Motley Fool

Rmd Table Rules Requirements By Account Type

Irs Proposes Updated Rmd Life Expectancy Tables For 2021 Life Expectancy Proposal Irs